Risk may be fun in the context of board games, but when it’s your business on the line, risk is something to avoid at all costs. Without sound controls in place, you could be leaving your organization wide open to threats that could cost you productivity, money and even proprietary information. While you can’t fully escape it, there are ways to minimize your risk and feel confident that your organization is stable and secure.

Common Risk Areas

Understanding common risk areas can help you create a plan to prepare, prevent and respond to incidents when they occur. Business risk comes in many flavors, but the major risk factors can be broken down into two categories: internal and external.

1. Internal Risk: Fraud and Internal Controls Issues

Did you know that five percent of a company’s annual revenue is lost to fraud each year? It may be hard to imagine it happening at your organization, but fraud is much more common than you might think.

When many of us think about fraud, we think about big-name criminals and high-profile embezzlement cases. But fraud is often a lot quieter than that. The circumstances that can act as a catalyst for fraud are illustrated by the sociological theory of the fraud triangle.

The three sides of the fraud triangle can be understood as follows:

- A motive could include high amounts of debt, family medical costs, housing market pressures, bad investment decisions, addiction problems (either substances or gambling) or the desire for a lavish lifestyle. Any of these pressures are further exacerbated when the economy is struggling.

- When the weight of these pressures becomes too much, people begin to rationalize their intentions. Rationalization to commit fraud may look like thoughts of “I’ll pay this back soon.” “No one will notice this is gone.” “I’m not hurting anyone.” These rationalizations can be justified further when employee morale is low. Low employee morale is linked to theft more often than low pay is linked to theft. When this low morale comes into play, the rationalizations may look like “the boss can afford it,” or, “they owe me.”

- The final side of the triangle is opportunity. Opportunities can arise in the form of exploiting job duties and responsibilities, taking advantage of weak internal controls and flying under the radar due to poor oversight.

Dealing with Internal Risk

Of these three factors, opportunity is the one that your organization has the most control over. You can reduce opportunity by implementing good internal controls and increasing the perception of detection; people rarely commit fraud if they think they will be caught.

Common ways to strengthen your internal controls include:

- Checking that stock and company credit cards are stored in a locked drawer

- Using dual authorization methods for electronic bank transfers

- Setting up user restrictions on accounting and computer software to limit access

- Locking inventory to assure limited employee access

- Performing employee background checks

Want to learn more about your potential risk factors?

You can further reduce opportunity and make reporting even easier by setting up a fraud hotline. In many cases of fraud, others were aware that something suspicious was going on, but they didn’t want to get involved. Providing employees with an avenue to report fraud easily and anonymously can go a long way; over a third of fraud cases are detected by a tip line, and, more often than not, employees are the source of the tip.

People are much more likely to speak up if it’s easy to. That’s why organizations with a hotline are 50% quicker at detecting fraud. An anonymous reporting service gives employees a safe way to report a potential incident so your organization can quickly address and work to mitigate the impacts.

We’ve developed a checklist to help you identify areas that could be susceptible to fraud.

Know What You’re Dealing With: Conduct an Internal Audit

Strategically evaluating and managing risk is critical for fraud prevention and the overall security of your organization. A strong, risk-based internal audit function will help you understand major risk areas and work to reduce fraud risk.

An internal audit provides an independent, objective review of internal controls, corporate governance and accounting processes and procedures. Not only can an internal audit help you reduce and mitigate risk, it can also help you improve processes and overall performance.

While it’s possible to have an internal audit function entirely in-house, you also have the option to outsource or cosource your internal audit. Not sure what’s right for your organization? Take a deeper dive here.

"We didn’t realize the amount of risk we had in our environment until we had Eide Bailly do a security assessment. It was eye opening."

- RECENT SECURITY ASSESSMENT CUSTOMER

2.External Risk: Cybersecurity Threats and IT Issues

Over 50% of companies have experienced one or more cyberattacks in the last 12 months, most of which went undetected for six months. That’s a long time for a threat actor to spend in your system gathering data, learning your business and seeking out vulnerabilities to exploit.

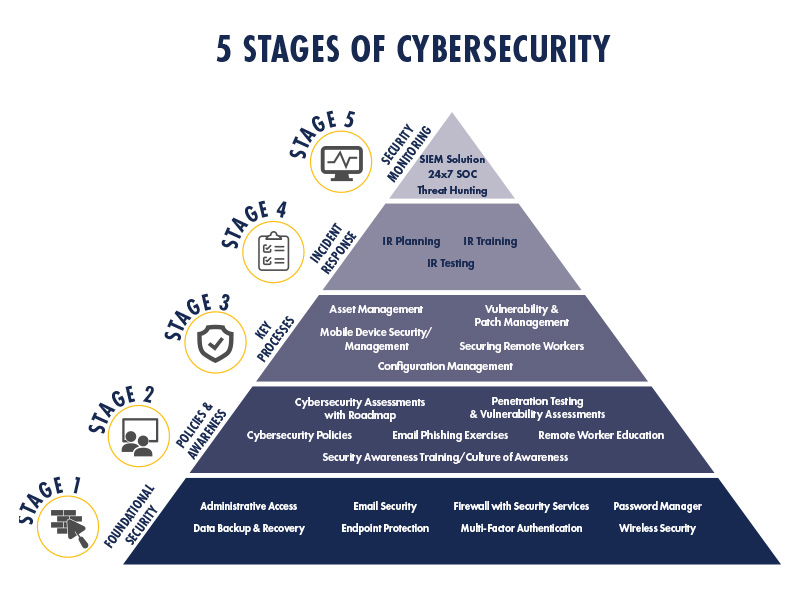

As organizations create comprehensive, in-depth cybersecurity action plans, we recommend they start with a good foundation and build their security up in stages:

While each has their own unique benefits, a true culture of security relies on each stage working together for peak efficiency and protection.

Need help determining what a culture of security looks like for your organization? Check out our in-depth guide to cybersecurity for more details.

Learning to Spot Areas of Risk

Risk is something that you’ll typically only find if you’re looking for it — and it's better to look for and find it before it finds you. The worst time to find out your potential risk is when it’s staring you in the face in the form of fraud or a cybersecurity incident. That's why proactive planning, and regular testing, can help you expose areas susceptible to risk and face it head on.

A holistic approach to risk management involves partnering with a team of advisors to examine multiple facets of your business. This includes:

- Forensic Accounting

- Risk Advisory

- Cybersecurity

- IT Systems

Working with a knowledgeable team who are well-versed in each of these areas is also a great way to stay in the know about current threats and incidents; one of the best ways to stay protected is to stay aware. Through preventative measures such as strengthening your internal controls, conducting an internal audit, addressing cybersecurity risks through penetration testing and incident response planning, and increasing your awareness, you can shed light on problem areas and create an organizational culture of security that minimizes risk and maximizes results.

We know you can’t see into the future. But we’re ready to help you prepare for it. Review your potential problem areas, and start building a culture of security today.

We're Here to Help