Key Takeaways

- Effective portfolios make sure to strike a balance between risk and return.

- Individuals can benefit from diversification because different assets react diversely to market conditions, economic factors, and unforeseen events.

- Investing without a clear purpose can lead to questionable results, like receiving a prescription without an exam.

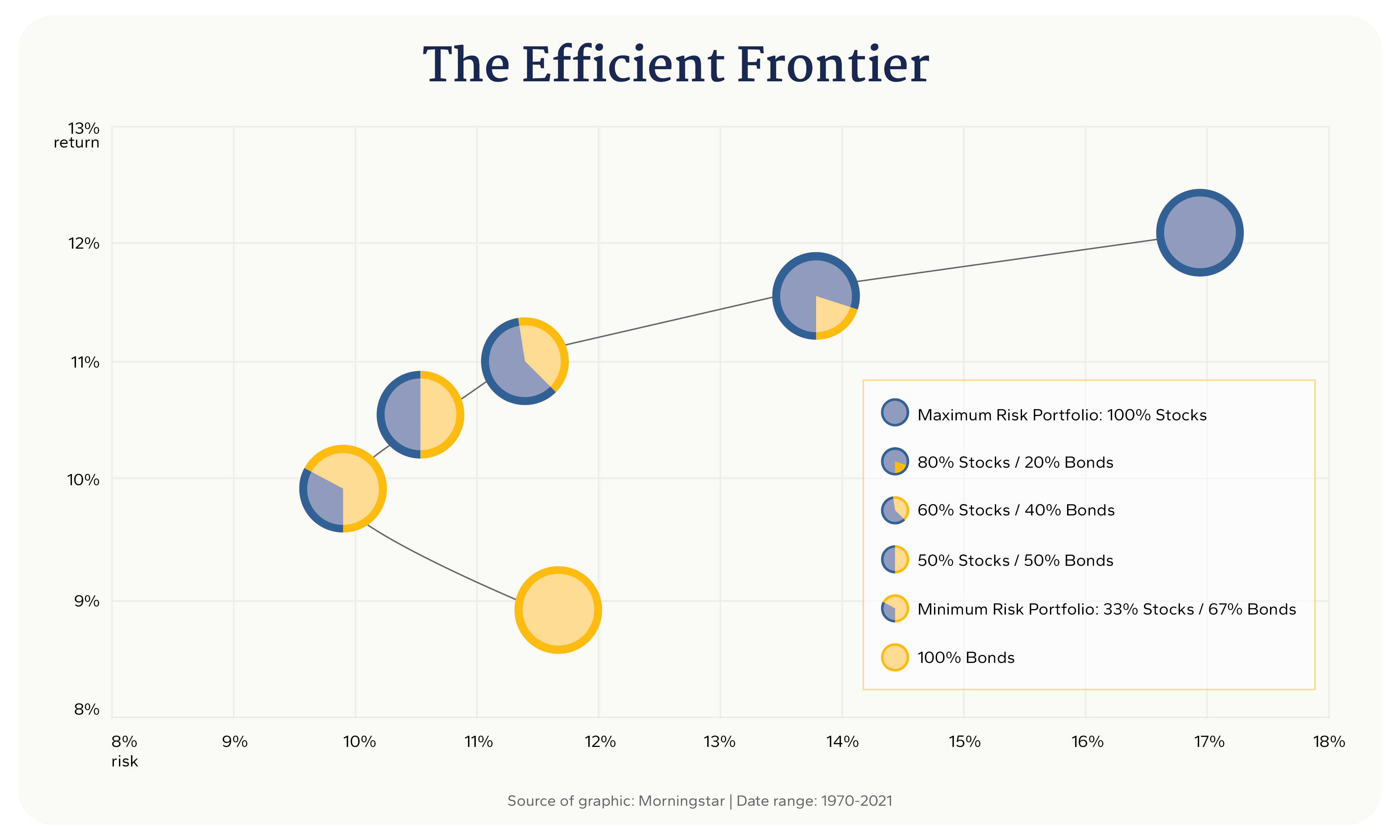

Diversification is a fundamental practice in investment strategy. It encourages avoiding the risk of concentrating all investments in one asset class. The efficient frontier — a systematic framework guiding the optimization of risk and return — offers a structured approach to putting diversification into practice.

This framework illustrates optimal portfolio choices given specific risk levels. Through the thoughtful blending of assets, investors can forge a more balanced and resilient investment strategy.

Portfolios along the efficient frontier strive to provide the best possible trade-off between risk and return.

Why “Riskier” Investments Can Lead to “Safer” Portfolios

The idea that "riskier" investments can contribute to the creation of "safer" portfolios may seem counterintuitive. However, individual assets may not move in perfect correlation with each other.

For example, when one asset within the portfolio experiences a downturn, another might be on an upswing, effectively offsetting losses. This diversification effect plays a crucial role in reducing the portfolio’s overall volatility, rendering it potentially less risky than the combined risk of its individual components.

The intrinsic benefit of diversification stems from the fact that different assets may react diversely to market conditions, economic factors, and unforeseen events.

By following this approach, investors can craft portfolios that are more resilient to market fluctuations. Diversification not only mitigates risk but also has the potential to furnish smoother and more stable long-term performance.

Understanding Your Investment Goals and Risk Tolerance

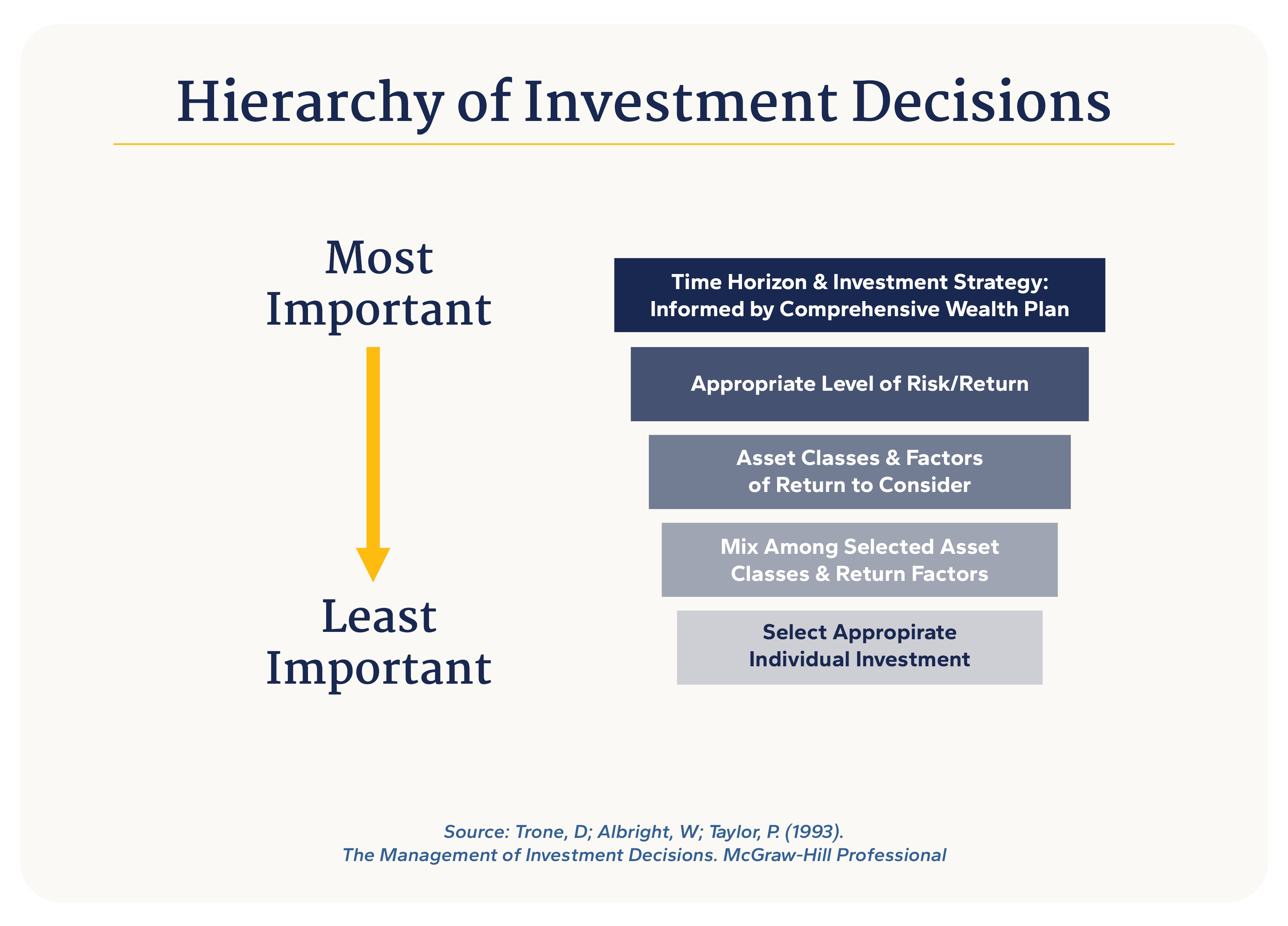

Effectively diversifying your portfolio — and thereby seeking to create an optimal allocation based on both risk and return, as illustrated in the efficient frontier — is contingent on understanding two key factors:

Your Investment Goals

Whether funding your retirement, caring for your loved ones, or other financial milestones, aligning your investments with your goals is paramount.

It’s not uncommon for our advisors to discover disparities between an individual’s stated objectives and the actual composition of their portfolios. This misalignment often stems from investing without a comprehensive understanding of your financial goals.

Investing without a clear purpose is akin to receiving a prescription without an exam. The success of such an approach is understandably questionable.

Your Risk Tolerance

Acknowledging your risk tolerance is equally critical. Understanding your level of comfort with the ups and downs of the market can help align your portfolio with your risk appetite.

Ask yourself:

- How much risk are you able to take on?

- How much risk are you willing to take on?

It’s also important to understand various other components, including:

- Time Horizon: This refers to the length of time an investor plans to retain their investments before accessing the funds. Short-term investors may opt for more liquid and stable investments, while those with a longer time horizon may choose a more aggressive approach, as there is more time to recover from market fluctuations.

- Tax Considerations: Strategies such as tax-loss harvesting and choosing tax-efficient investment options can enhance after-tax returns. Tax code varies by jurisdiction, so it's important to stay informed about the tax implications of your investment decisions.

- Liquidity Restraints: Liquidity measures how easily an asset can be traded in the market without impacting its price. If an investor faces unexpected financial needs, having a portion of the portfolio in liquid assets can be crucial. However, overly prioritizing liquidity may result in lower returns, as less liquid assets often have the potential for higher long-term gains.

By collaborating with professional advisors, you can gain clarity on how these factors impact your investment strategy and identify the liquidity requirements necessary to achieve your goals.

The Challenge of Diversification

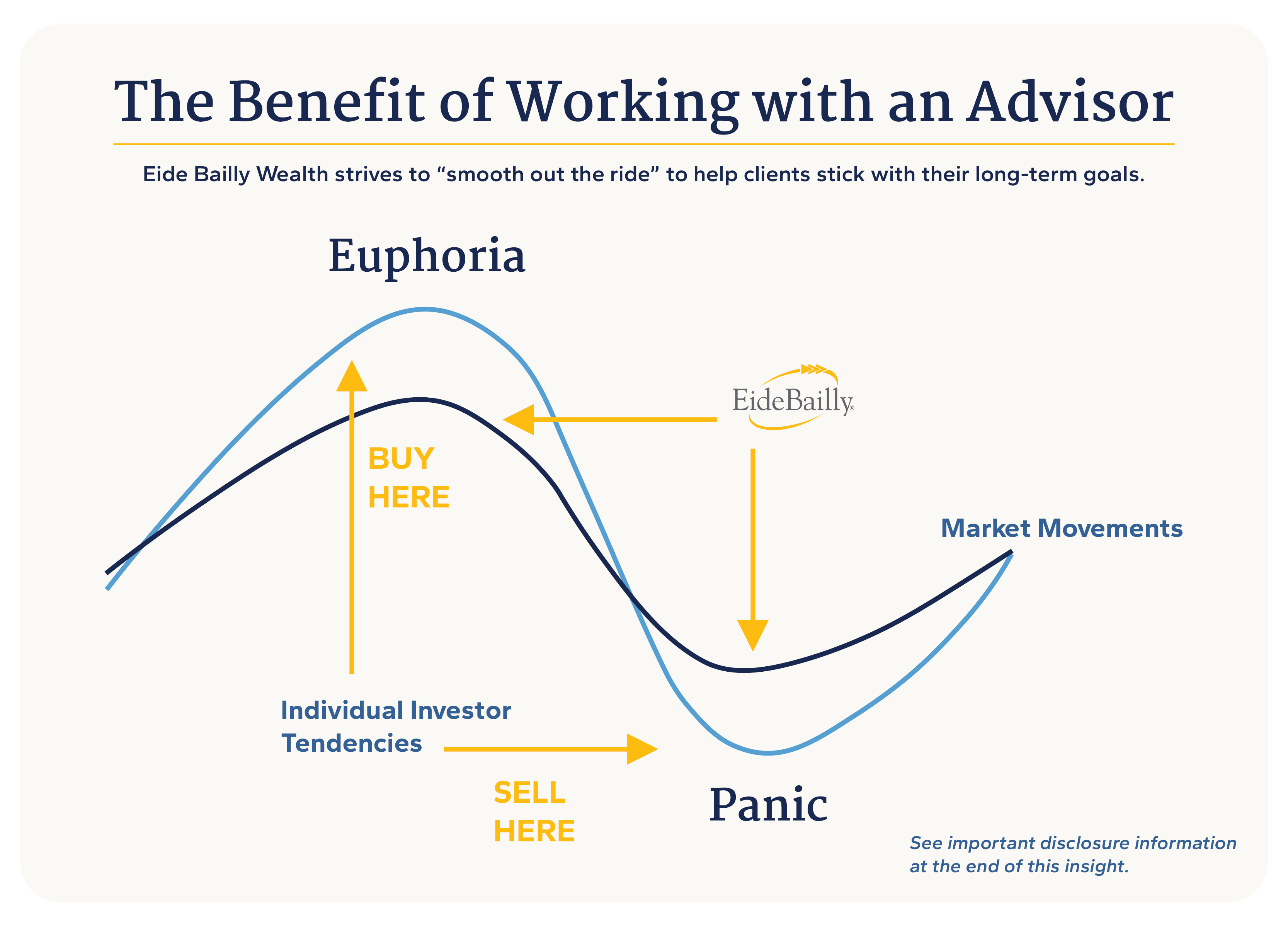

Emotions can significantly impact the success of diversification in an investment portfolio. Feelings of fear, anxiety, or overconfidence can lead investors to make irrational decisions that may undermine the principles of diversification.

Here are some ways in which emotions can make diversification challenging:

Overemphasis on Recent Performance

If a particular asset class or investment has recently performed well, investors may be tempted to overweight their portfolio in that area. This behavior is influenced by the fear of missing out on continued strong performance.

Loss Aversion

Loss aversion is a behavioral bias where individuals feel losses more strongly than gains. Investors may avoid certain asset classes perceived as riskier, even if they have the potential for long-term growth. This aversion can result in a less diversified and more conservative portfolio than may be optimal for achieving financial goals.

Overconfidence

Overconfidence can lead investors to believe they can time the market or pick individual securities better than others. This overestimation of one's abilities may result in concentrated positions rather than a diversified portfolio. Overconfident investors may also neglect the importance of risk management and assume they can consistently beat the market.

The vulnerability caused by human emotions underscores the importance of seeking external guidance. Advisors can help stabilize feelings of confidence or uncertainty throughout your investment lifecycle, providing an experienced and unbiased perspective to your strategy.

A Wealth-Centric Approach to What Matters Most to You

At our core, we are committed to truly knowing our clients and forging strong relationships with them. This deep understanding allows us to navigate the intricate factors influencing portfolio construction.

Our mission is to guide you toward a wealth-centric approach that aligns seamlessly with your aspirations, ensuring that your portfolio reflects not just your financial objectives but also your unique journey and priorities.

Eide Bailly Advisors, LLC as a matter of policy, does not give tax, insurance, or legal advice to its clients. The effectiveness of any of the strategies described will depend on your individual situation and on a number of complex factors. You should consult with other professionals, as applicable on proposed strategies before any strategy is implemented.

Lessons Learned in Investing — 5 Strategies for an Effective Portfolio

Eide Bailly Wealth

Define what matters to you today while anticipating your needs for tomorrow with a comprehensive plan.