Key Takeaways

- 75% of victim organizations increase review procedures after fraud takes place.

- Having defined controls and processes removes sentimentality and personal bias from the equation.

- Indications of fraud are less visible and harder to identify with a remote workforce.

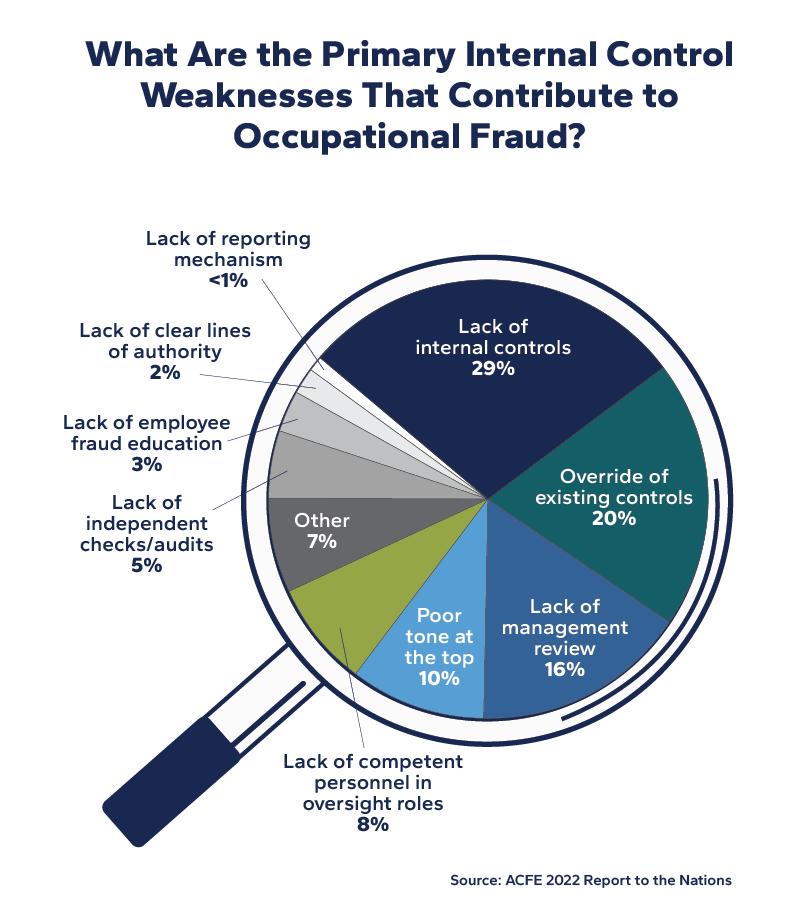

The most common factor underlying occupational fraud was a lack of internal controls, according to ACFE’s 2022 Report to the Nations.

29% of victim organizations did not have adequate controls in place to prevent the fraud from occurring. Another 20% of cases involved an override of existing internal controls, meaning the organization had implemented mechanisms to protect against fraud, but the perpetrator was able to bypass those controls.

Together, this data shows that nearly half of the frauds likely could have been prevented with a stronger system of anti-fraud controls.

Internal Controls to Reduce Fraud Risk

Internal controls are a crucial component in defending against fraud within an organization. They are a set of policies, procedures, and practices designed to safeguard a company's assets, ensure the accuracy of financial information, and prevent fraudulent activities.

Examples of internal controls include:

-

Segregation of Duties:

This principle separates responsibilities within an organization. For example, the person responsible for authorizing transactions should be different from the one responsible for processing them. Separation of duties reduces the risk of one individual having too much control.

-

Approval and Authorization:

Transactions should require proper approval and authorization before they are executed. This ensures that transactions are legitimate and comply with established guidelines.

-

Documentation and Record-keeping:

Detailed and accurate records are essential for tracking financial activities. They provide a trail of evidence, making it easier to detect discrepancies or irregularities that might indicate fraud.

-

Reconciliation and Review:

75% of victim organizations increase review procedures after fraud takes place. Periodic reconciliation of accounts and thorough reviews of financial statements help identify discrepancies or unusual patterns.

-

Training and Awareness:

Educating employees about fraud prevention and the organization's internal controls is essential. When employees understand the importance of these controls and their role in enforcing them, they are more likely to act as a first line of defense against fraud.

While no system can completely eliminate the risk of fraud, well-designed internal controls can significantly reduce the opportunities for fraudulent activities and enhance the organization's ability to detect and prevent fraud in its early stages.

The Significance of Internal Controls in Fraud Prevention

Organizations tend to rely heavily on trust as an internal control. In a normal business cycle, this can cause issues. In a remote working environment, it can have a long-lasting impact on the organization. Effective and established internal controls are necessary to prevent fraud and protect your operation.

The foundation of proper internal controls starts with setting the right tone from the top, where leaders lead by example and maintain a zero-tolerance policy for non-compliance. This accountability is equally important for both remote and in-office employees.

Establishing and maintaining internal controls can be complex. Emotions can cloud judgment and influence individuals' perspectives and decision-making. It’s easy for processes to become flawed and for details to fall through the cracks—especially with a remote workforce. That's where clear policies and procedures come into play.

Having defined controls and processes removes sentimentality and personal bias from the equation. It’s not about trust or the individual—it’s simply protocol.

Problems arise when management neglects to hold employees accountable for their actions—or inaction. When management fails to adhere to internal controls, employees have greater opportunity to manipulate their job duties and take advantage. Management must insist on proper cross-checking and reviews.

The Impact of Internal Controls on Your Accounting Department

Effective internal controls are vital for your organization’s accounting department, influencing:

- Banking reconciliation

- Invoice review

- Payment review and approval

- Vendor verification and acceptance

- Payroll verification and approval

When working remotely, these controls can add an additional layer of oversight to approval processes. Emails between individuals and organizations are automatically time and date stamped. Senders can also request "read receipts" or "delivery completed" notifications, providing a record for verification purposes.

If you’re concerned about limited segregation of duties in your organization, consider reviewing:

- Bank statements

- Cancelled checks

- Cash receipts

- Inventory counts

- Payroll processing

Additionally, examine these aspects of your cybersecurity plan to reduce external fraud risks:

- Email accounts

- Computers/servers

- Networks

- Mobile devices

- Data retention/deletion

- Electronic funds transfers

Cultivating a Fraud-Resistant Culture as an Internal Control

When people are out of sight, they can also be out of mind. Indications of fraud are less visible and harder to identify over the phone or via a video conference call.

The ACFE reports one of the leading red flags for fraud is living beyond one’s means, and the leading detection strategy is through tips. In virtual work environments, employees interact less frequently, making it more difficult to identify questionable activity. This may enable further fraud, allowing employees to take advantage with less risk of being noticed.

One effective and cost-efficient internal control strategy for preventing fraud in remote work environments is to instill a culture of security and fraud prevention within your company.

This approach establishes a "perception of detection" throughout the organization.

Consider it this way: People are less likely to speed or run a stop sign if they believe they will get caught. The same principle applies in the business context. Most individuals are unlikely to commit embezzlement if they believe they will be apprehended.

As organizations navigate the evolving landscape of remote work, the importance of internal controls cannot be overstated. By implementing these robust safeguards and fostering a culture of vigilance, organizations can significantly reduce the risk of fraudulent activities, ensuring the integrity of their operations and the security of their financial assets.

Cryptocurrency Investments: How to Avoid Scams and Invest Safely